Dear Subscribers,

Here we are, 67 days into 2014, and the S&P 500 has risen a measly 36 points. And in that time, the index has also had a 161 point swing from the bottom in January to the top at the start of this month. Investors dislike volatility, and when markets become turbulent, investment capital makes its way to the exits… that is, at least until markets can prove themselves.

We continue to maintain our hypothesis from the start of the year. In ‘What to expect in 2014‘ we stated:

In our view, the (really) easy money is over. 2013 was the year to front-run this massive shift into U.S. equities, and the market responded in spades. You could have thrown darts at an index of stocks and done quite well (unless you were a hedge fund). But after a 30% return in 2013, what does the market do for an encore?

If the S&P were to rise another 30% this year not only would this be a miracle, but P/E multiples would be at dangerous nosebleed levels and we’d all be in trouble. A more reasonable 10% gain this year would get us to 2,000 on the index – a nice round number, and an area many analysts are calling for.

To achieve a return of any more than that in 2014 will require a little more discriminate stock picking, and that’s where our algorithmic research comes into play.

To wit, on March 13 we warned against taking new long positions – the reason being because our algorithms identified a 2 year profitable trading pattern that finally broke down:

From a quantitative perspective, when cycles break down, the #1 rule in algorithmic trading is to reduce positions or exit entirely, thus contributing the volatility. In the 5 weeks that followed our warning, markets have moved sideways confounding longs and shorts alike.

Clearly, Global Markets are undecided as to the direction of the next move. Today, investors sought clues in the FOMC minutes released at 2:00pm, but they saw nothing that would warrant breakout of the current sideways movement, and so here we are stuck between 1850 and 1880… for now.

We care about the direction of the S&P 500 because, theoretically, this is an all encompassing barometer of risk trends – not only within the US, but world wide.

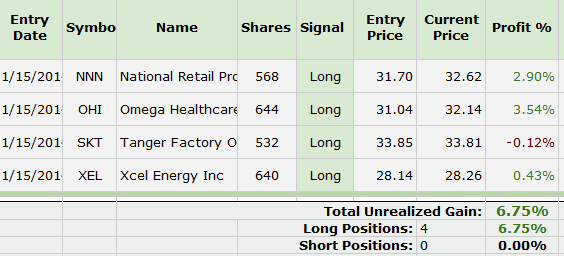

Since our March 13th warning the S&P 500 gained a mere 1%, where our core subscriber portfolio gained 10%, which puts our monthly gains in the median range of the best performing hedge funds of all of 2014.

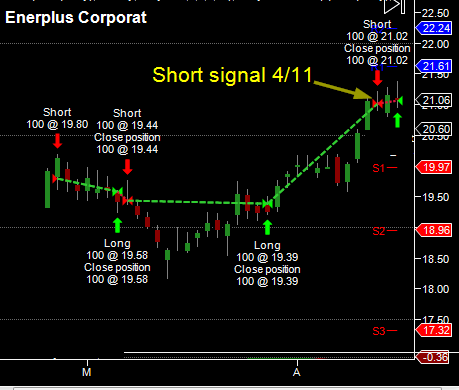

While many are staying on the side lines waiting for markets to resolve themselves, we have taken some trades which have a relatively high probability based on some shorter-term trends we have been witnessing (see our past posts) combined with our quantitative algorithmic signals:

March 14: ConAgra Foods: 4%

March 24: Cliff’s Natural Resources: 4%

March 24: Mosaic: 2.2%

April 15: Compass Minerals: 7%

In the High Reward/Risk portfolio, CCIH gained 16% before trading below our entry point by 8% – a testament to current market volatility, especially in Chinese names. Our 2 short Facebook trades (capitalizing on momentum selling) returned 1.7% and 1.3% respectively.

In our post 2 Trades to capture interim capital shifts, we called for a down turn in both Oil and Oil stocks, and a down turn we did get. Oil subsequently dropped to below $100, and both XOM and CVX did have a move down, but the down move was short lived as share buy backs were announce to levitate their respective stock prices.

Going forward we continue to follow the line of our three core themes:

1. Inflation due to global quantitative easing by central banks on a global scale.

2. A range-bound US equity market.

3. A slow, grinding upwardly mobile interest rate environment.

We have also started tracking additional side themes that have materialized, namely:

1. A slow-down in advertising spending

2. Capital flows into independent oil/gas companies.

3. Capital flows out of stocks with high valuations.

On a more positive note, the side ways motion we are seeing in the S&P 500 is good. As we stated in January: “What we hope for is a healthy correction. What we may end up with is a huge short squeeze.“

Markets are definitely on the verge of a break out, and which direction they break still remains to be seen.

Current Facebook Long Trade:

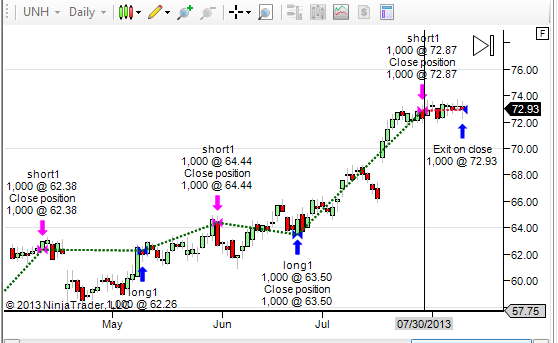

Today we alerted to a Buy signal on Facebook (NASDAQ:FB) – this is in line with a profitable trading pattern going back to the company’s IPO in 2012 and is the same pattern which generated the Sell signals last week for a quick 3% gain in 2 days.

As of today, that algorithm has switched to Long, and we are quite confident as to the strength of the historical pattern. In fact, since our signal at 58.50, Facebook spiked to $60.40 after hours for a 1.5% gain, and we expect further upside.

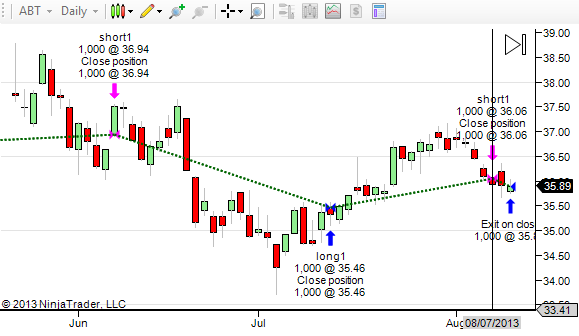

Long-term Facebook patterns continue to be profitable (click to enlarge)