The start of a calendar year is a time for capital shifting. Large funds lock in their profit for the previous year to juice their bonuses as well as paint a good picture on the year’s performance for their investors. This January however is one of the most volatile months in recent memory as a number of demographic, geopolitical, and centralized planning themes create market chaos.

Indeed, the CBOE Volatility Index hasn’t been this high since June of last year, and at this point it is more profitable selling options contracts than to invest their underlying securities.

Emerging Markets currency problems appear to be the theme of the month, and a good part of the turbulence can be attributed to investors weighing in on the impact to Western markets.

For us, our algorithms work on statistical probabilities based on historical events, and when the correlations and historical patterns break down, the number one rule in pattern trading is to wait on the side lines. As a result, we have been mostly in cash as markets continue to reconcile because, as that super computer in War Games once said, sometimes the only winning move is not to play.

The large fund reporting deadline is still 1 week away but we continue to monitor the feed as early reporters submit their 13F forms. It is at that time when we will have the best investment picture for 2014. Until then, the complete picture of what large funds are positioning for is somewhat incomplete. Holdings for the third quarter of 2013 show large positions in Financials and Emerging Markets, but those sectors are down considerably in 2014. For the 4th quarter, large funds are either going to double down on their positions, or like John Boehner, as if investors are going to call it a decade and go completely into defensive stocks and other assets such as corporate bonds.

Until we get the big picture next week there are some smaller scale fundamental themes we are tracking which we can capitalize on now with Exchange Traded Funds:

Overall Market Theme: Fed Taper Continues

The Fed taper is for real. Since it was announced in May of this year, commodity values have generally collapsed and banks have rallied. Because a reduction in Fed stimulus places upward pressure on interest rates, commodities become the losers (due to various factors). Banks, who have muddled along handing out low margin, low interest rate loans for the past 5 years and feeling the pain of miniscule rate spreads, are finally enjoying higher margins. Also benefiting are Insurance companies, who rely mainly on bond yields as their own profit staple.

Sub-Theme #1: Markets Settle

The S&P index has a 16% weight in financials, and is one of the reasons the index has also rallied furiously since the May taper talk. However both the Financials and S&P have seen a significant pull back since January, possibly after the latest January FOMC taper report stating that the Fed cut back $10 Billion in bond purchases. $10billion – a minimal amount of money by Fed standards – pales in comparison to the Fed’s $trillion-plus balance sheet. As we blogged last week, the yield-chasing capital flight out of bonds into emerging markets may have been over done, and some larger funds who wanted to jump the gun on what should be the trade of the year, are now flowing back into the relatively (read: less volatile) 10 year treasuries.

How To Profit:

It’s hold or fold time for the S&P index: Either it’s time to buy the dip in equities, or stand aside and wait for the selling to subside. Corrective moves are rarely easy to play as the duration is so short, however it could be a safe bet to short the volatility as markets settle down.

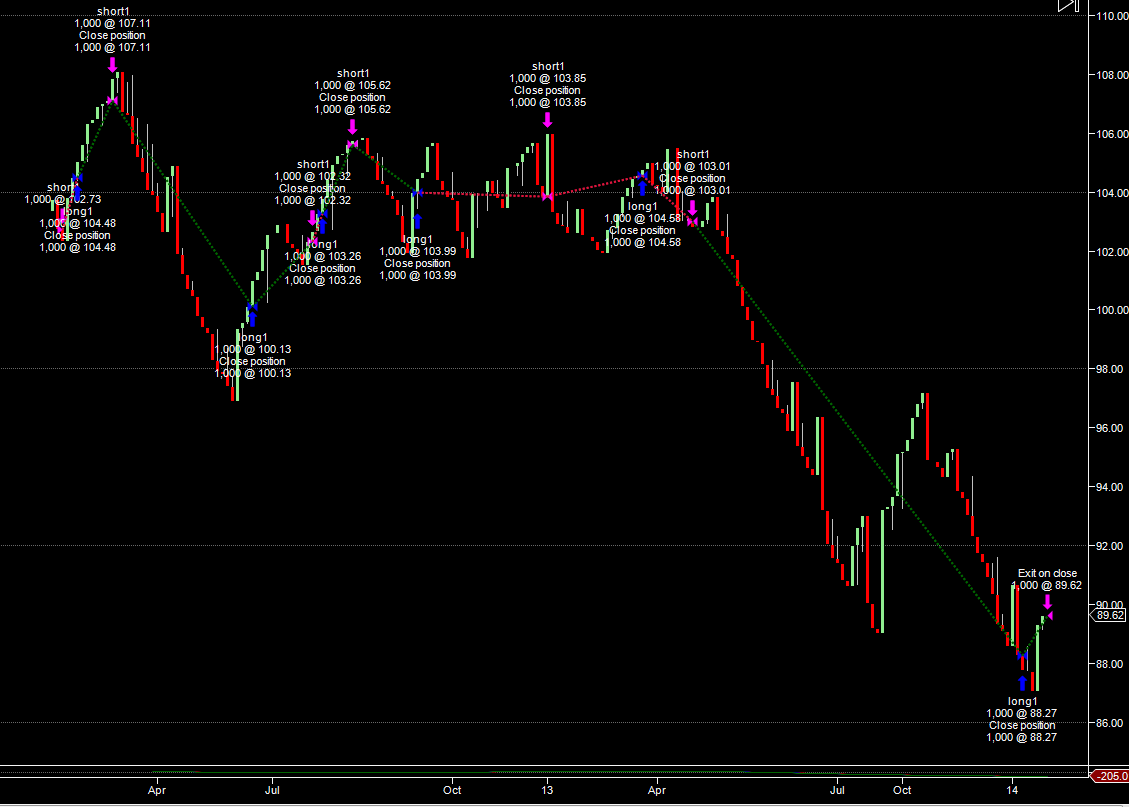

Shorting the Volatility Index (VIX) has been a favourite trade of larger funds since the May taper talk, and there is no reason for this profitable trade not to continue. For this we will use an inverse volatility ETF, the XIV. The algorithm picked up a Selling pattern on the VIX Index as well as a recent Buy signal on XIV, based on a long-only pattern since January 2012...

Sub-Theme #2: Banks benefit from interest rate normalization

The correction in the Financials appear to be complete, and the normalization of interest rates will continue to feed into their bottom line.

How To Profit:

The algorithm picked up a strong short-term Buy signal on the XLF financials ETF. Long term, a bullish pattern that has been present since January 2012 continues to be in tact even after the sell off. We have also scanned the entire Russell 1000 financials index and a number of them appear to be turning the corner on the recent down trend.

**Sub-Theme #3: A bet on Inflation

**

Even with the Fed taper there is a lot of newly printed money sloshing around the markets (see our 2014 thesis). We should be seeing hyper inflation, but we are not. Instead, the commodity complex (see chart) had dismal returns in 2013. Commodity based currencies such as the Canadian and Australian Dollar have been in free fall since the Fed’s taper announcement, however the situation is about to change…

This year we have sen hard assets such as Gold, Oil and Natural Gas stabilize, and in some cases rise, since January. The Gold miners have had a bounce, and our reliable indicator has settled above the key $8 mark (see post).

How To Profit:

While it may be to early to bet the farm on commodities rising, the correlated commodity currencies should get a lift before the cycle finally takes hold. We picked up an algorithmic Buy signal on the Australian Dollar/USD currency pair. The FXA ETF, currently trading near fresh lows, is poised to take advantage of any rise forward…