Interactive Brokers – popular among the ‘smart money’ crowd – released the top 5 shorted stocks by sector as of today (April 15) and the top 5 largest short positions (4/11). It seems the energy sector is ripe for a correction like we called 2 days ago (April 13) with our “Short Big Oil” call.

Other notable entries: Blackberry ($BBRY) which has unsuccessfully been trying to put in a base, and a number of high profile banks such as Citigroup ($C) which has been trading well below its 200 day moving average.

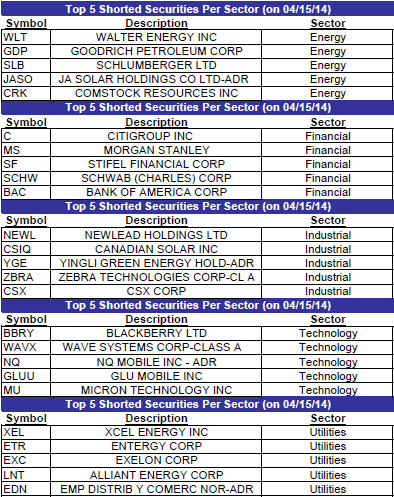

Top 5 Shorted Securities as of 4/15:

Top 5 shorted stocks by Sector (source: IB)

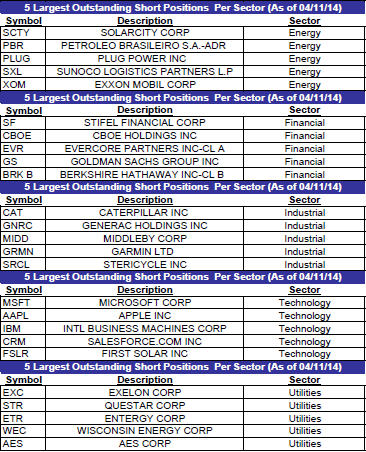

Top 5 Largest Short Positions as of 4/11:

Top 5 outstanding short positions by Sector (source: IB)

IB’s posts can be found here and here.