Tag Archives: Facebook

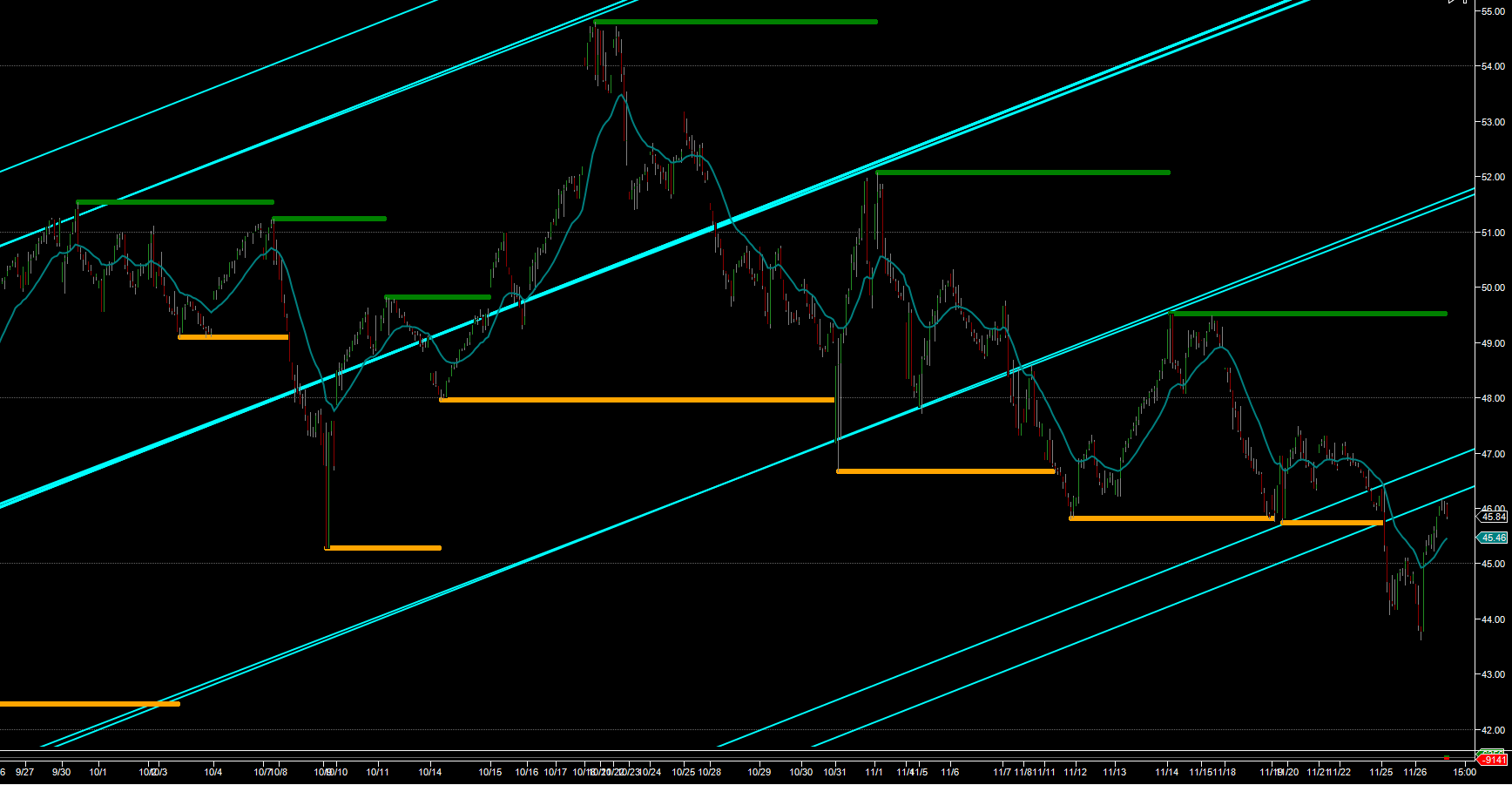

Facebook: key up channel broken

This is a screen shot (click for full image) of our trading screen showing a very simple regression channel with a few standard deviations (10 min line-break bars) which has defined Facebook’s upward trend since August. This channel was officially broken yesterday morning (11/25) which, not withstanding a retest of the $46-47 range, should indicate further declines from here. This is how we would make a human-based decision based on probabilities, but our Facebook Stock Predictor algorithm is typically more accurate than us and ultimately makes the final call.

The Facebook Stock Predictor – now a premium service

We first launched the Facebook Stock Price Predictor as a public service to showcase our technology to potential clients, and hopefully help out a few investors along the way, including some of our friends and family who were invested in the stock (against our recommendations). We have had great feedback from our followers and we have enjoyed sharing the signals and exchanging ideas.

It is with mixed feelings then that we are announcing our decision to transform the Facebook Stock Predictor into a private service for paid subscribers.

Facebook: Exactly how many active users have a pulse? we may never know…

.

The Facebook Stock Predictor algorithm generated a SELL signal late in the regular US trading session on 11/6 and we notified our email list members immediately. This was after a Neutral position was maintained for the past 5 trading days – a demonstration of computer-grade patience as the market resolved its slow grind.

Last night our team exchanged bearish ideas as to why the stock price might go lower from here. One of our programmers told a story about how is 80 year old mother sent him an invite to ‘connect’ on LinkedIn: This elderly lady unfortunately fell for a well known trap where LinkedIn logs into your email account and collects all of your contacts and indiscriminately sends every one of them an invitation to ‘connect on Linkedin’. You can read about this unethical practice and the class action law suit at the New York Times.

Social Network users: Quality vs. Quantity vs. Non-Existent

Linkedin no doubt counted this 80 year old mother and each one of her vulnerable, elderly contacts who clicked on an Invite as an actual ‘user’, even though she won’t use the site again (and neither will her contacts). Users acquired under such unscrupulous circumstances would explain the sky-high user numbers Linkedin and Facebook reports each quarter, and would also explain their high valuations.

Facebook also uses similar tactics to increase their user base. Their approach isn’t quite as aggressive, but it’s equally unethical.

This raises the question: What is the actual number of ‘quality’ Facebook’s users?

Opinion: Facebook Valuations, Analysts, and Monkeys…

It’s easy sometimes to get caught up in market opinions and forget one of the most fundamental reasons for investing in any asset: buying now with the expectation that someone will want to buy it from you in the future at a greater price.

Beware of analysts pushing stock… and monkeys

It sounds simple enough, but what’s easy to forget is that the price of any asset (real estate, antiques, etc.) is set by markets, not by what you personally believe it’s worth.

Financial instruments such as stocks, commodities, bonds, and their ETF proxies should also be approached with the same level of diligence – that is, to understand what the current drivers are behind prices, and to know how much other investors will feel they are worth in the future.

To answer such questions we rely on a number of widely accepted indicators, such as corporate earnings, advertising, our own greed and instincts, or perhaps what our peers and family members happen to be buying at the time. Many fortunes have been made by this method, and many more have been lost. More disturbingly, a good number of analysts exploit this and write up feel-good stories to convince people into thinking assets will appreciate in the future, right or wrong.

Facebook Q3 Earnings Commentary: ‘If you can’t get rid of the skeleton in your closet, you’d best teach it to dance’

How it all began

Facebook’s earnings conference call last night reminded us of that scene in ‘The Social Network‘ when Mark Zuckerberg and Eduardo Saverin argue over introducing advertising to Facebook..

EDUARDO: It’s time to monetize the site.

MARK: What does that mean?

EDUARDO: It means it’s time for the website to generate revenue.

MARK: I’m asking how do you want to do it?

EDUARDO: Advertising.

MARK: No.

EDUARDO: We’ve got 4000 members.

MARK: ‘Cause the Facebook is cool. If we start installing pop-ups for Mountain Dew it’s not gonna–

EDUARDO: Well I wasn’t thinking Mountain Dew but at some point–

MARK: We don’t even know what it is yet. We don’t know what it is, we don’t know what it can be, we don’t know what it will be. We know that it’s cool, that is a priceless asset I’m not giving it up.

EDUARDO: When will it be finished?

MARK: It won’t be finished, that’s the point. The way fashion’s never finished.

EDUARDO: What?

MARK: Fashion. Fashion is never finished.

EDUARDO: You’re talking about fashion? Really? You?

MARK: I’m talking about the idea of it and I’m saying it’s never finished.

EDUARDO: Okay, but they manage to make money selling pants…

Zuckerberg ultimately got his way, and things haven’t changed much since then.

The price of Facebook’s shares are directly related to the company’s speed and ability to turn their users into products for advertisers.

While Facebook’s ability to productize their users is not an issue (they have the means and the lack of ethics to do so), the company’s timing is what made the stock swoon during the conference call last night after market hours.

Facebook: Sell signal generated, but wait for the trend

After nearly 5 months the Facebook Stock Predictor has generated a Sell signal.

The Sell signal means that, based on historical trading patterns dating back to the stock’s IPO in May 2012, the algorithm has assessed a high probability of further declines from today’s levels.

This algorithm has had a high degree of accuracy to date so we have every reason to follow it, however in this current euphoric upward trend, it would be wise to use caution.

Facebook: who’s buying?

Update – Nov. 15 – Goldman finally files their 13F for the quarter, and reports that they sold off 1.8 million shares. You can read their filings on the SEC web site here.

—

Update – Oct. 29: Goldman still hasn’t filed a 13F for the past quarter. The 45 day deadline is November 17th. Looking at their past history they typically file at the last minute, likely to avoid moving the stock against the positions that they are taking. We continue to monitor the filings as they come in.

—

We have been crunching statistics based on the recent 13F filings that have been trickling in for the July-September quarter.

13F is a regulatory form that institutions must submit once each quarter disclosing their positions. Filers have 45 days after the quarter to disclose, and we are on the 21st day so as the filings are submitted and posted, we are starting to see a better picture of which ones are buying, selling, and standing pat on their positions.

NASDAQ shows this data on their site, but it’s not as thorough as proprietary reports (such as Thomson or Factset), so we fill in some of the blanks to get a more complete picture:

Facebook: One more short squeeze for the road

Those who have been following our Facebook posts know that our projections have been correct, and our Facebook Stock Predictor has stayed with the trend since June. The algorithm’s long position did not get shaken out on those price drops along the way to today’s levels, including a $5 plummet we experienced last October 8th and 9th which has nearly been erased, climbing back up to the $50 level as of this morning.

Leaping on to a fast moving train: Where does Facebook go from here…

We haven’t posted much commentary on Facebook recently, but this is mainly because we are awestruck on the stock’s levitation and our algorithm’s ability to stay with it.

When we first launched the Facebook Stock Price Predictor we wanted to showcase our technology to potential clients, and hopefully help out a few investors along the way. We were hoping that FB would trade in a range that would trigger buy and sell signals on our algorithm that we could publish in real time… but the stock has climbed nearly straight up since June and we haven’t seen any opportunity to post a Sell signal in months. Instead, we just watched our algorithm ride the rocket, posting our opinion at key price levels along the way which, in the end, turned out to be correct each time.

But FB is now oscillating in and around the $50 level, which equates to double the price since June and a good place for a lot of investors to lock in some gains. So the question of the day is: Does FB have more room to run, or could this be the top?

Painting the tape on Facebook…

We can’t believe it, but we are still long Facebook (FB)

An update on our current Facebook Stock Predictor buy signal: Our commentary on September 16 had a technical target price of $47, and the stock reached this price in a powerful move last Friday. Continue reading

We’re still riding the Facebook wave, but when will it crash?

Our Facebook Stock Price Predictor has been right on the money, and we are freely publishing the signals here for all to see because we hate seeing investors get burned. This cold-hearted computer algorithm has stayed with the up-trend since the June Buy signal for a 72% gain to date (89% overall since February).

So even though we are on the record saying we hate Facebook as a company, these days we are growing to like the underlying stock for 2 simple reasons…Continue reading

We hate Facebook, but the short squeeze continues (with no sign of letting up)

Let us be clear: We hate Facebook. We hate Facebook for the same reason we hate LinkedIn… both of these social networking sites have:

- replaced real human interaction in the business and social world, when really they should be augmenting it

- tricked people into providing access to their email inbox and bombard the contacts of those who fall for it

- implemented loose (call it immoral) privacy policies… remember: you are not the user, you are the product

- have stock valuations that are far above their fair value

Facebook just became a $100 billion (with a ‘b’) company in terms of market cap. To maintain this high-flying stock price Facebook must find ways to make a lot of money fast, otherwise their holiday party is going to be a real downer this December. If you’re running Facebook, what do you do with your marginal advertising revenue (disrupted by increasing mobile use) and over 1 billion users? You monetize every last ounce of flesh out of your user base, and this requires that you do a whole lot of bad things you probably wouldn’t even do to people you don’t like, let alone your own visitors.Continue reading

Facebook Algorithmic Stock Price Predictor says ‘don’t sell yet’

Our Facebook Stock Price Predictor algorithm continues to impress. The June 22 buy signal at $24.60/share has shown an outstanding 61% gain on that one move alone, and the trading strategy is running a cumulative profit of 75% to date. Last week Facebook had already rocketed to $38.00 and we published this blog post warning to keep hanging on as the algorithm indicated further gains: [Facebook Stock looking to cheat the shorts – Aug. 22]

So where does the Facebook stock price go from here?Continue reading

Facebook Stock looking to cheat the shorts

Since we published our Facebook Stock Price Predictor earlier this year the algorithm has worked beyond our expectations, thanks to our crack team of technicians, theorists, and programmers. Facebook has been on the market for just over a year so it is difficult to establish clear patterns, but our algorithm has identified at least one and has returned over 70% since inception.

Since their July earnings announcement, Facebook has popped a whopping $13 (50%) , so one would be forgiven for believing the stock is ripe for a correction (..and, for the record, we think so too based on our research into fundamentals and company risks) however, in today’s algorithmic and mania-driven markets, we’ve learned that the market does whatever it wants to, even if it’s contrary to company fundamentals.Continue reading