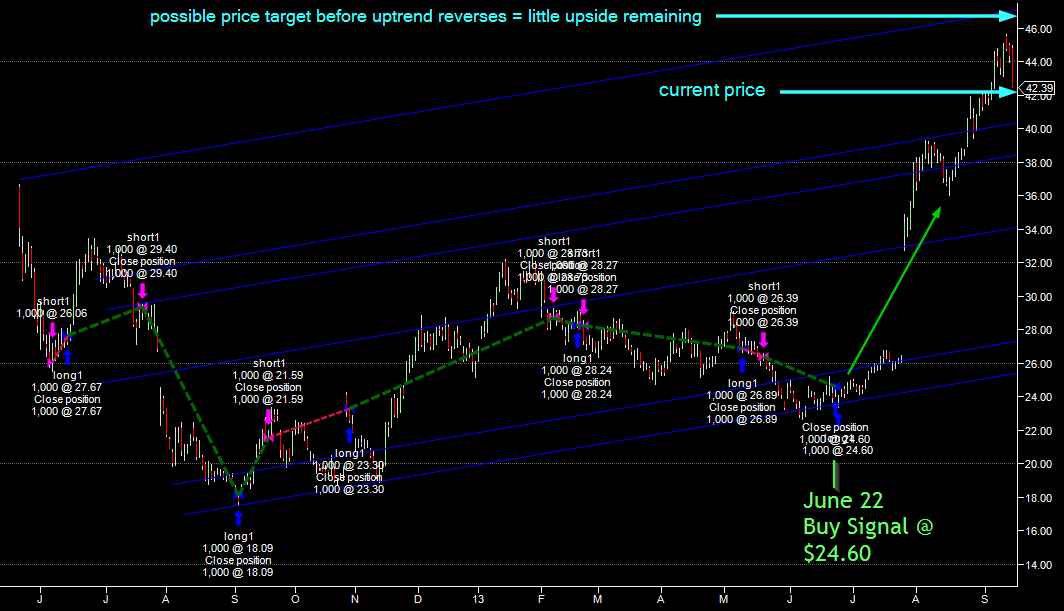

Our Facebook Stock Price Predictor has been right on the money, and we are freely publishing the signals here for all to see because we hate seeing investors get burned. This cold-hearted computer algorithm has stayed with the up-trend since the June Buy signal for a 72% gain to date (89% overall since February).

So even though we are on the record saying we hate Facebook as a company, these days we are growing to like the underlying stock for 2 simple reasons…

1. Strong Trading Patterns Abound: Nobody knows for sure how much Facebook is worth. The market cap is over $100 billion, but a fair share price has dozens of factors built into it, most of them being speculative in nature. When this happens the stock can experience wild swings as the market goes through a process of price discovery. Price discovery means traders and investors are looking at the past as a measure of a fair price today. Because of this, the stock becomes a great candidate for algorithmic trading, which attracts a lot of trading robots which in turn can make trading patterns even more predictable… and our Facebook Stock Predictor algorithm likes all of that.

2. Institutional Ownership: According to NASDAQ, 50% of the float is owned by institutions. Institutions typically protect their positions from a precipitous drop (if they are long… or meteoric rise if they are short) which means that a stock that has heavy institutional ownership will trend nicely in either direction.

To recap our calls so far:

On August 21, FB had rocketed to $38, but the algorithm was still long. We warned of an imminent short squeeze, and the stock went higher as predicted.

On August 28, FB broke $40 and we continued to warn not to sell.

On August 30, FB went to $41 and we called for a blow-off top.

Since then, FB did blow off that top and shot to $45. However, this price level seems to be the target price for a lot of those institutions who are looking to take some money off the table and the stock has been trading in a range between $42 to $45 since September 7th.

So What’s Next?

Exiting a stock is one of the most difficult decisions that an investor can make. We are making our own decisions based on what we know and what we think:

What we know:

1. We have a target price of $47/share which we have calculated using technical methods. This is a guide line based on probabilities, and the market can ultimately do whatever it wants, but in our experience just when you think a stock can’t go any higher it smashes through the roof.

2. The proprietary indicator on our algorithm is still showing bullish strength and is suggesting additional gains.

What we think:

1. New Positions: In terms of risk/reward, it is senseless to enter new long positions from here only to capture a limited potential upside move. Intraday traders might think otherwise, but here at Intellikon this doesn’t fit within our risk parameters (i.e. we don’t have the balls)

2. Current Positions: In terms of locking in profit, we prefer to cash in some of our gains here rather than wait for that last bit of upside to reach our target price (which may or may not materialize before the next algorithmic sell signal)… like a professional surfer knowing when to bail before crashing into the shore, getting the maximum ride out of a wave.

3. Shorting: We’ve learned never to short while our algorithm is long, so we’ll just wait for the next signal before doing that.

4. Exiting: If the algorithm generates a SELL signal, we would exit the long position entirely.

If you’d like to be notified of the next FB signal ( it won’t be tweeted) send an email to our listbot at [email protected]