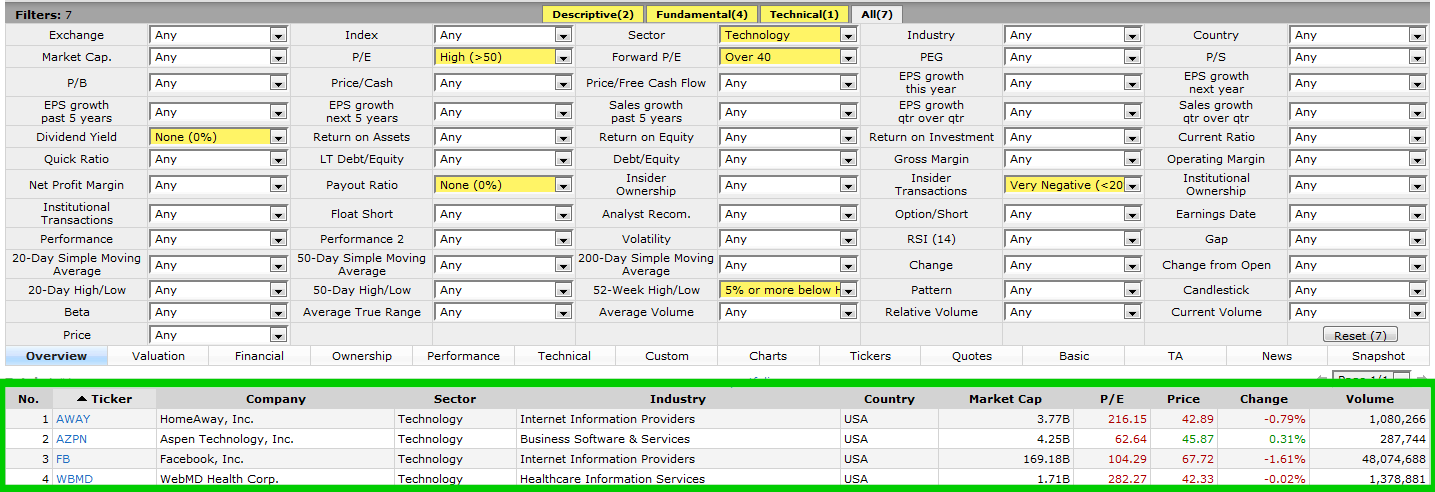

We used Finviz to create a stock screener that will show companies trading similar to Facebook.

This is what we came up with:

Sector: Technology

P/E: Over 50

Forward P/E: Over 40

Current Dividend Yield: None

Historical Payout Ratio: None

Insider Transactions: Very Negative: more than 20% of insider shares being sold

52 Week High/Low: Current price is more than 5% below 52 week high

Full screen can be viewed here. As you can see, only 3 other companies share Facebook’s elite market status.