Earlier this month we asked our subscribers to give us the symbol of a stock, ETF or Future contract they are watching and we would run it through the algorithm to see which signals come up.

Priceline.com (NASD:PCLN) was mentioned as a possible short candidate, to which we responded on 11/15:

We discussed PCLN this evening and ran it through the algorithm. It looks like a short, feels like a short, but definitely not a short… yet.

A number of traditional technical indicators however would seem to show that the stock is poised for a correction:

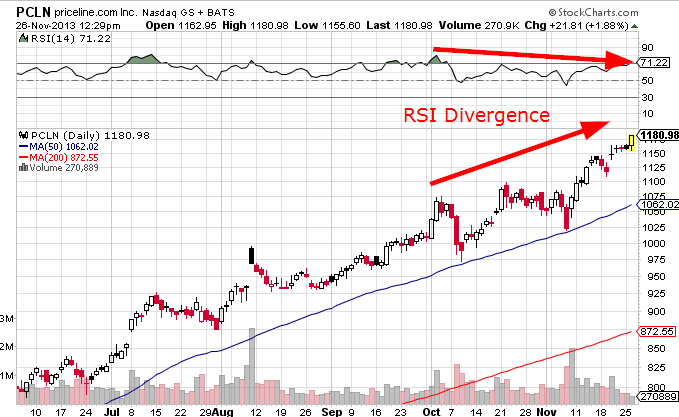

PCLN is showing divergence between price and RSI which could be a bearish indicator…

PCLN has been trading above a well established channel for the past few weeks and is rising further – could this be the start of a blow-off top?

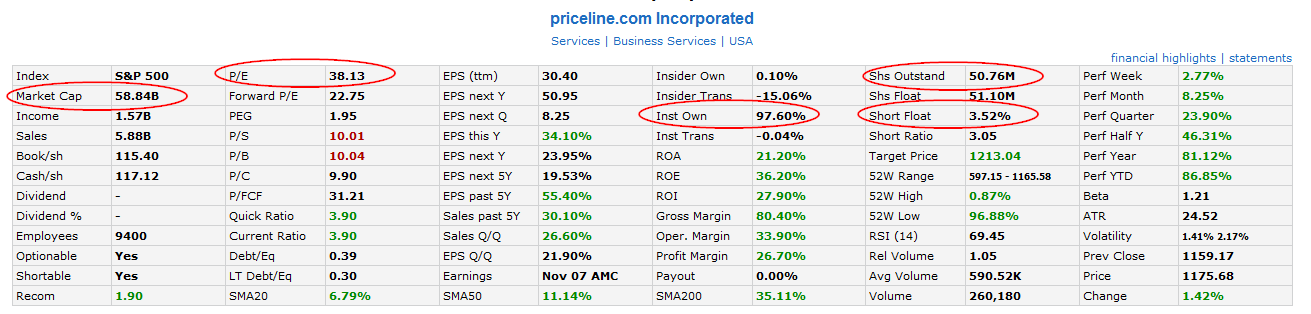

Fundamentally speaking however PCLN could just be getting started in a parabolic move. The Short float is only 3.52% of the total shares outstanding, which doesn’t indicate that this stock is hated by any measure. The P/E ratio is 38.13 which doesn’t quite make it a bargain, but this has been about the average for the entire S&P. In our view, what could make this stock go higher is the fact that there are only 50 million shares outstanding on a stock with $58 billion market cap – this means that anyone invested in the stock is likely in it for the long term. Indeed, large institutions own 97% of the company, which would explain why any an all dips have been bought since May…

Add to this the fact that there are a lot of unlucky folks out there who survived a round of work layoffs and still have a job – these people have taken on the load of their former co-workers, are severely overworked, overdue for that vacation they probably put on hold last year to show how much of a team player they are (and that they can be just as hungry as the temporary foreign worker hovering around the office ready to take over their own job), and suddenly there’s a glut of people willing to pay companies like Priceline.com top dollar for a few days in paradise.

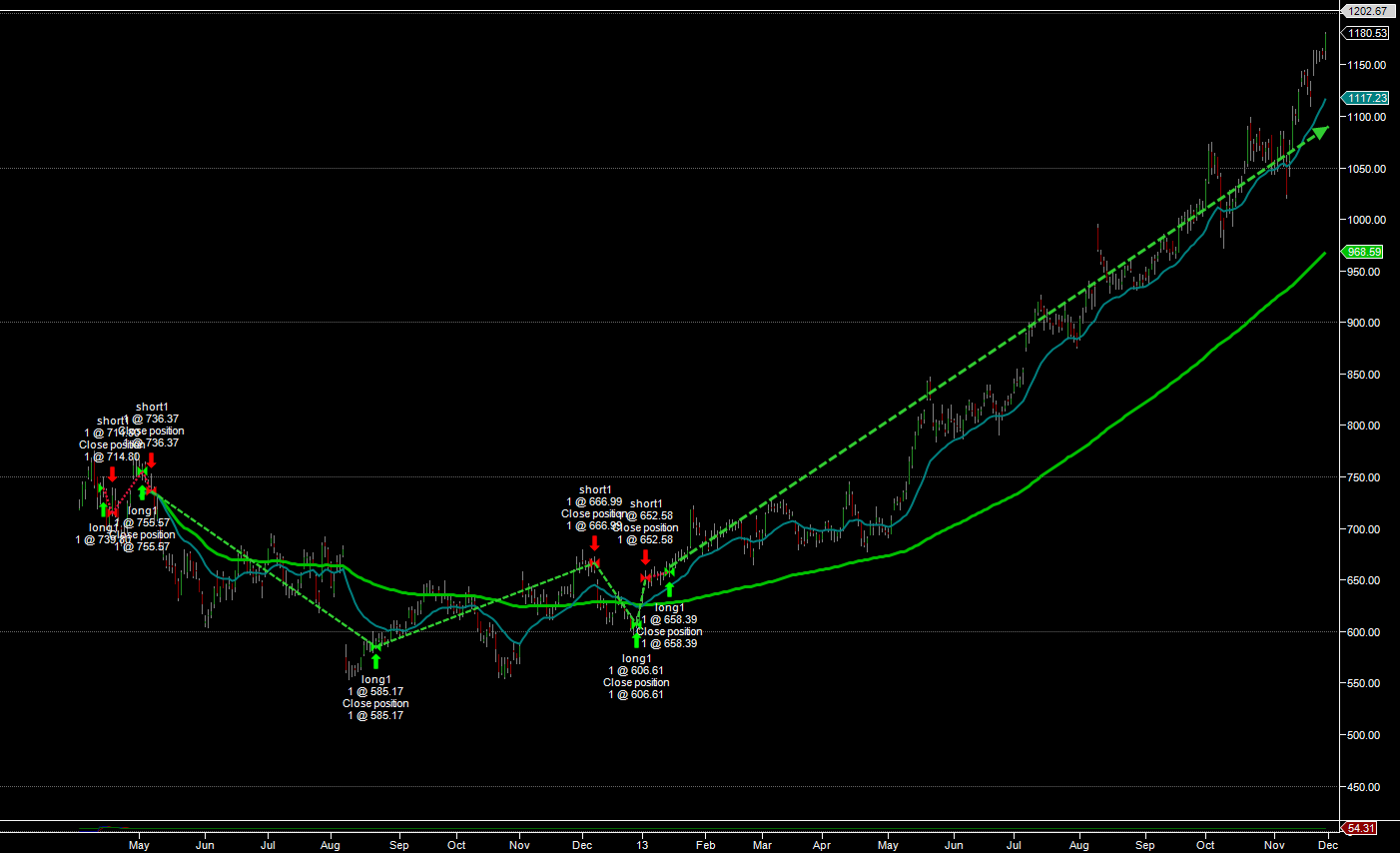

But beyond all of that, our own algorithm shows continued upside in PCLN, based on a trading pattern it identified going back to **April of 2012 – the last buy signal occurring on January 15 2013:

**

If and when Priceline becomes a short candidate, our algorithm will most certainly pick up the signal, and when it does we will notify subscribers immediately. Buying at all-time highs is not within our risk parameters, but according to the current signal, buying PCLN has a better chance of being profitable than short selling it outright.